Lendwithcare brings together entrepreneurs in low-income countries with the people that have the power to help them - people like you. Run by CARE International UK, one of the world's leading poverty fighting organisations, Lendwithcare is a revolutionary way for you to help people to work their way out of poverty with dignity.

Here's how it works:

1) It starts with an idea

From launching a scrap recycling business to diversifying crops and everything in between, entrepreneurs living in low-income countries are bursting with ideas - all they need is a helping hand to get started.

2) The entrepreneur requests a loan

Entrepreneurs approach one of Lendwithcare's local development partners for a loan. If their plans to invest in their business show promise, their loan is approved and they'll have the go-ahead to get started.

Most Lendwithcare partners charge interest on loans to help cover the high operational costs associated with reaching low-income customers with small loans. More information is available here.

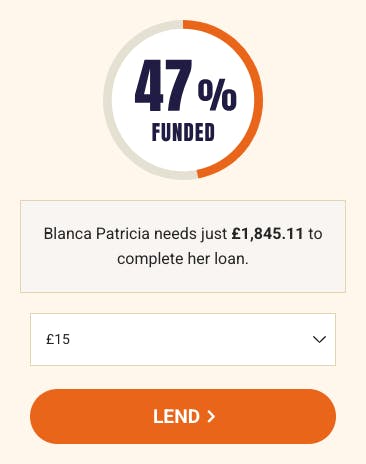

3) You lend to an entrepreneur

The local partner adds the entrepreneur's profile to the Lendwithcare website where they will join other entrepreneurs from different locations across the globe. You can browse all entrepreneurs available for funding and choose which promising business idea you'd like to support.

4) The entrepreneur’s business grows

After an entrepreneur receives their Lendwithcare funding, they will get to work starting or growing their small business. We try to keep all entrepreneur profiles updated so you can see how their business is progressing.

5) Your loan is repaid

Entrepreneurs pay back their loans in installments to local partners, who in turn transfer these repayments to CARE International. We then credit the repayment to your Lendwithcare account. Please note that most of the loans you choose to support will have been distributed in local currency. Repayments will be subject to currency exchange fluctuations. More information is available here.

6) You decide what happens next

When a loan is repaid, the vast majority of lenders will choose to make more loans, helping more low-income entrepreneurs to turn their hopes for a better future into reality. You can also withdraw the credit if you wish or make a donation to support Lendwithcare's operating costs and other important poverty fighting initiatives from CARE International UK.

Want to know more?

Help centreWant to find out how you can make a difference?

Start lendingWhat is microfinance?

Many of Lendwithcare's local development partners are specialist microfinance institutions (MFIs). Microfinance refers to financial services for poor and low-income people. Although the main focus is on the provision of small loans, microfinance also includes the provision of other basic financial services such as savings, money transfer and insurance.

What happens after I lend?

At the end of the month after the loan is funded, we transfer the funds to our local partner who transfer it to the entrepreneur if the loan hasn't already been pre-disbursed. Your chosen entrepreneur then uses your loan and makes repayments to your Lendwithcare account on a regular basis. Repayments are often monthly but sometimes quarterly or half-yearly.

Lendwithcare's local development partners

In most cases, Lendwithcare's local partners are specialist microfinance institutions (MFIs) providing loans to entrepreneurs. You can find out more about each of our local partners here.

If 100% of my loan goes to the entrepreneur, what about operating costs?

Lendwithcare relies on voluntary donations from lenders like you to cover operational and growth costs. This is why we invite all lenders to make a monthly donation as a Lendwithcare Angel and/or make a voluntary top up donation when making a loan.